tax per mile reddit

Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Has the highest fuel tax in the nation at 587 cents per gallon recently began discussions on whether or not an 81-cent-per.

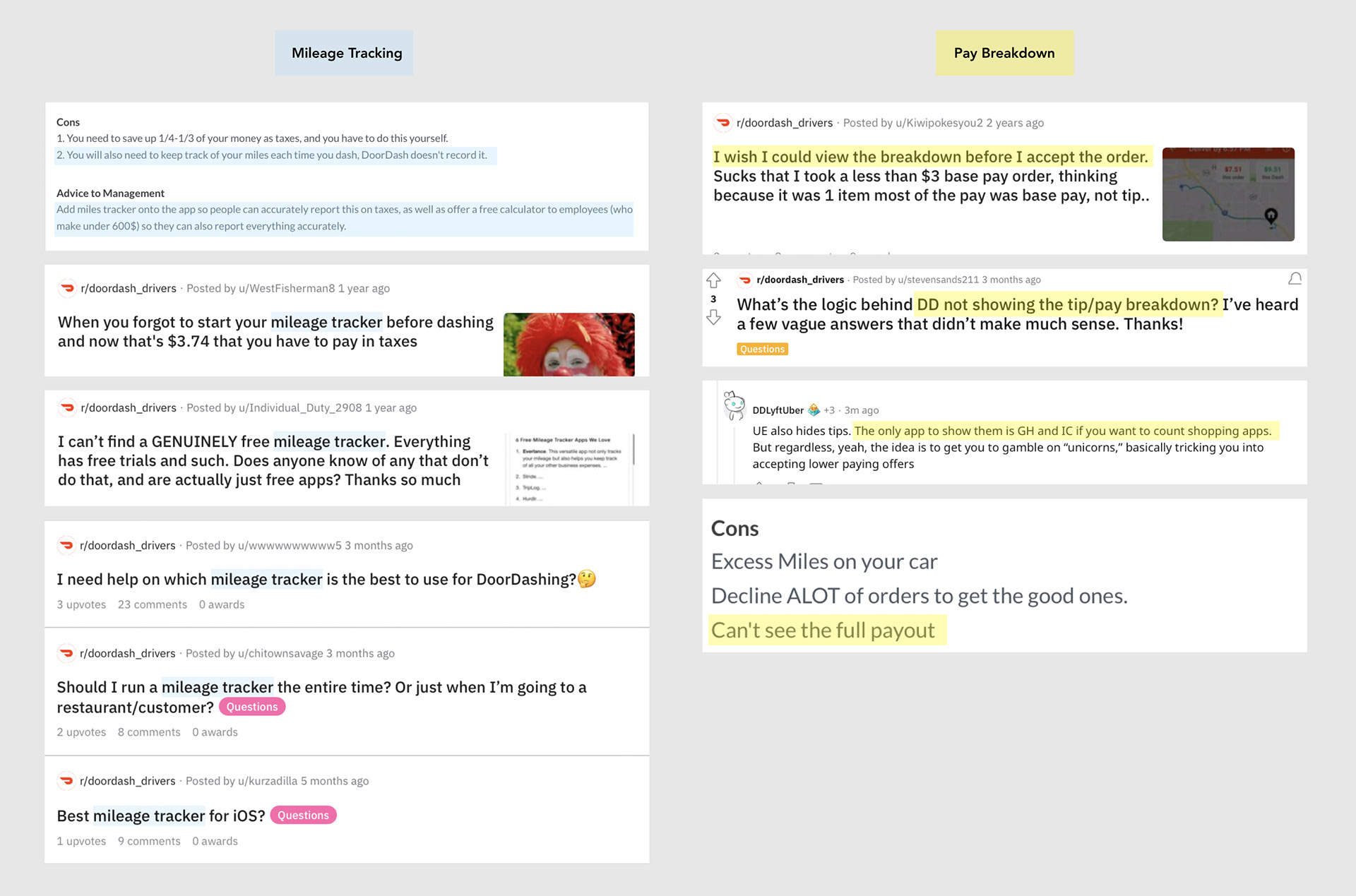

Raymond Banke Dasher App Redesign

Here you can write off a flat amount per mile.

. 2 Car tax to be ring-fenced and actually. You may also be able to claim a tax deduction for mileage in a few. Search titles only.

I imagine if this is ever implemented even though we dont get to write off the miles we drive as employees for the 060mile that businesses can write off Id think thered be mileage tax. Either through increasing fuel duty or using mileage readings taken during an MOT. Where Can Taxes be Paid.

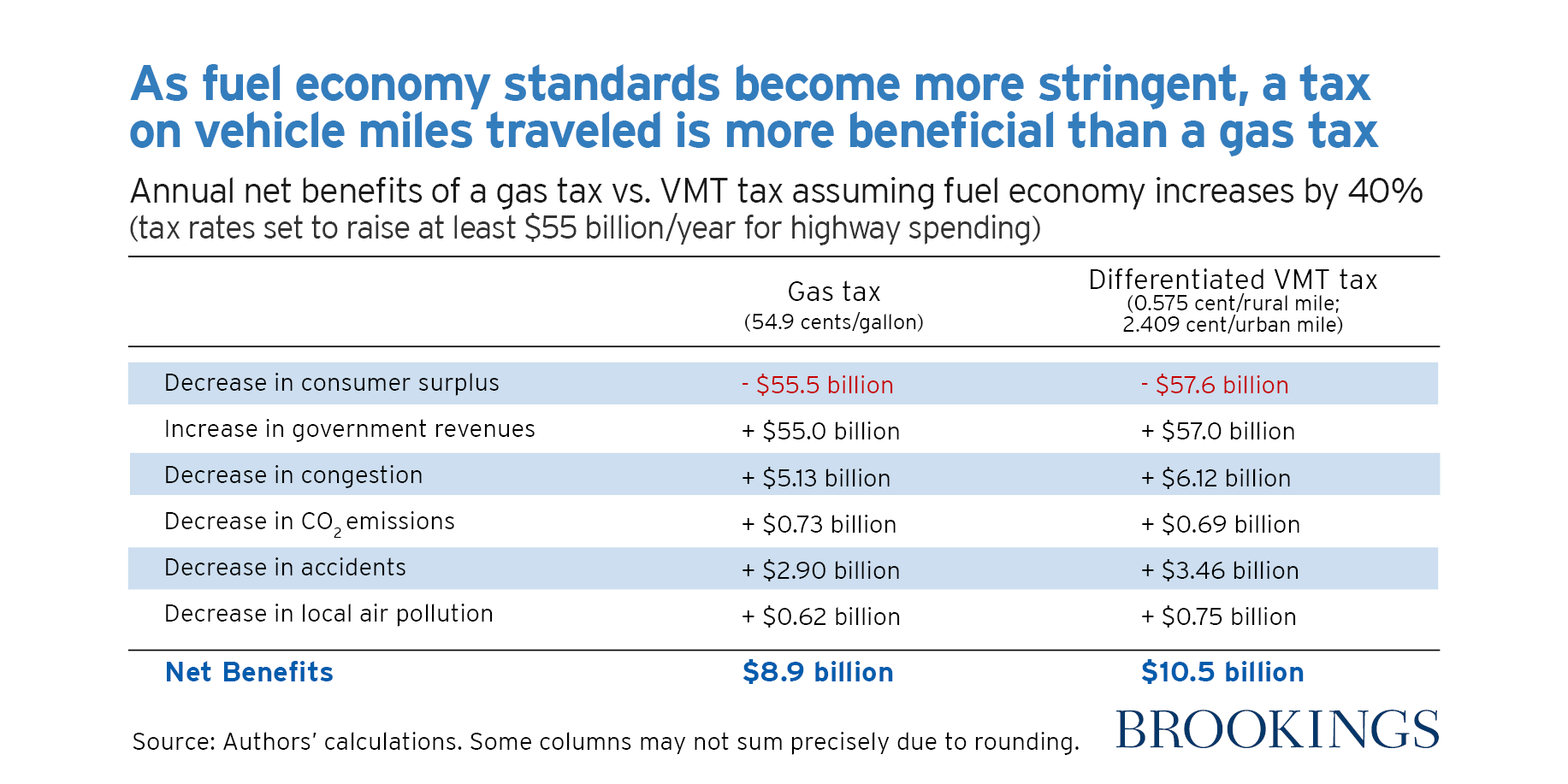

For the 2022 tax year that is 585 cents per mile for the first six months and 625 cents for July through December. A gas tax is much better because it encourages people to drive fuel efficient vehicles. A tax per mile.

1 A pay-per-mile road tax rewarding people for driving less. Americans should not allow GPS tracking of cars trucks. 56 cents per mile driven for business use down.

Tax per mile reddit Tuesday July 5 2022 Edit. However the tax-free amount is 45p per mile. Search all of Reddit.

The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed. Californias taxes are some of the highest in the US with a base sales tax rate of 725 and a top. The first major concern with a per-mile tax is in how the data would be collected.

The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax. DoorDash drivers can deduct their mileage by either claiming the federal reimbursement for mileage 56 cents per mile in 2021 or by claiming actual expenses. Vehicle mileage taxes are just an attempt to shield people who drive gas guzzlers from paying for the.

That comes to 80 a year for anyone who drives 10000 miles in a 20 mpg car.

Legislature Considers Toll Commission Per Mile Fees Possible

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

Fact Check No Driving Tax Of 8 Cents Per Mile In Infrastructure Bill

A Mileage Tax No Biden S Bill Doesn T Impose New Driving Tax Snopes Com

The Absolute Best Doordash Tips From Reddit Everlance

What Would A Vehicle Mileage Tax Mean For Ride Share Freightwaves

Buttigieg Proposal For Vmt Tax Nothing New For Utah That Launched Pilot Program Last Year Kutv

How To Claim The Standard Mileage Deduction Get It Back

California S High Gas Tax Set To Go Higher Orange County Register

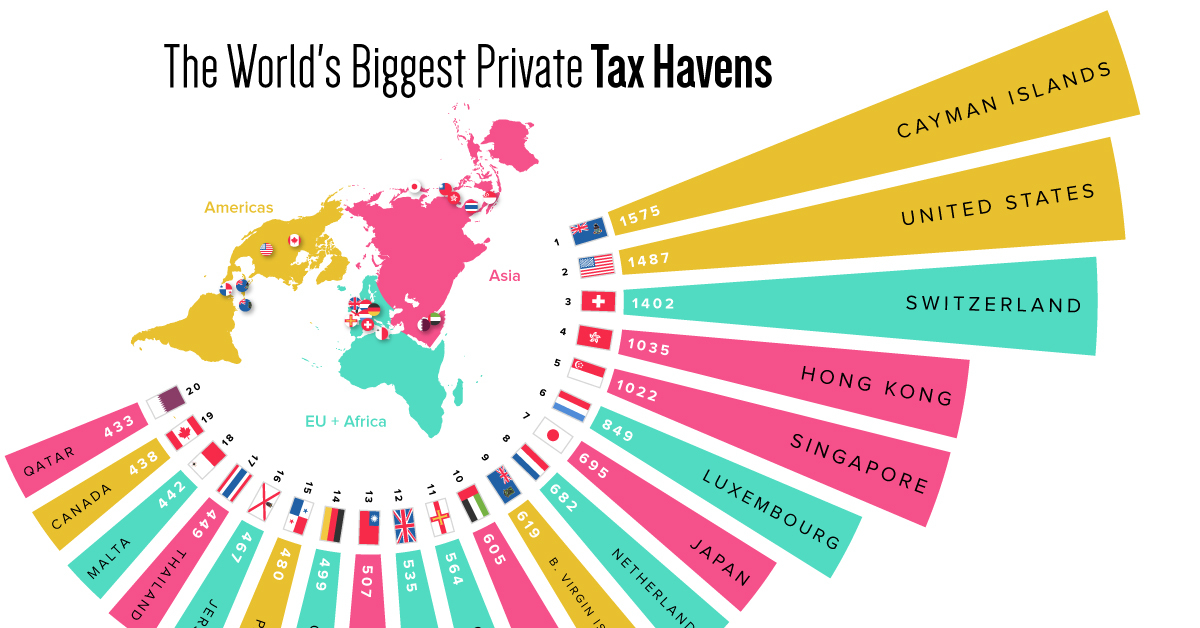

Mapped The World S Biggest Private Tax Havens In 2021

What S Behind California S High Gas Prices

Evs Of 2022 Msrp Per Mile Of Range After The 7 500 Tax Credit If Applicable Us Only R Teslalounge

Blog Tax Deductible Landlord Expenses The Ultimate Checklist

The Internet S Insane Art Project Explained The Hustle

.jpg)

Should You Buy An Ev Out Of State Some Shopping Tips

Amazon Com Audexen 300w 9 Inch Round Led Work Light Pod Lights Built In Emc High Low Beam Driving Lights With Adjustable Mounting Bracket Compatible With Jeep Wrangler Off Road 4x4 Truck Atv Suv

California Prop 30 Income Tax For Electric Vehicles Calmatters

How To Use Reddit For Business In 2022

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded